Finance Business

Corporate loans, factoring services, and investments in securities for the purpose of generating revenue for dividends, and other

![]() NEC Capital Solutions Limited

NEC Capital Solutions Limited

Corporate loans, factoring services, and investments in securities for the purpose of generating revenue for dividends, and other

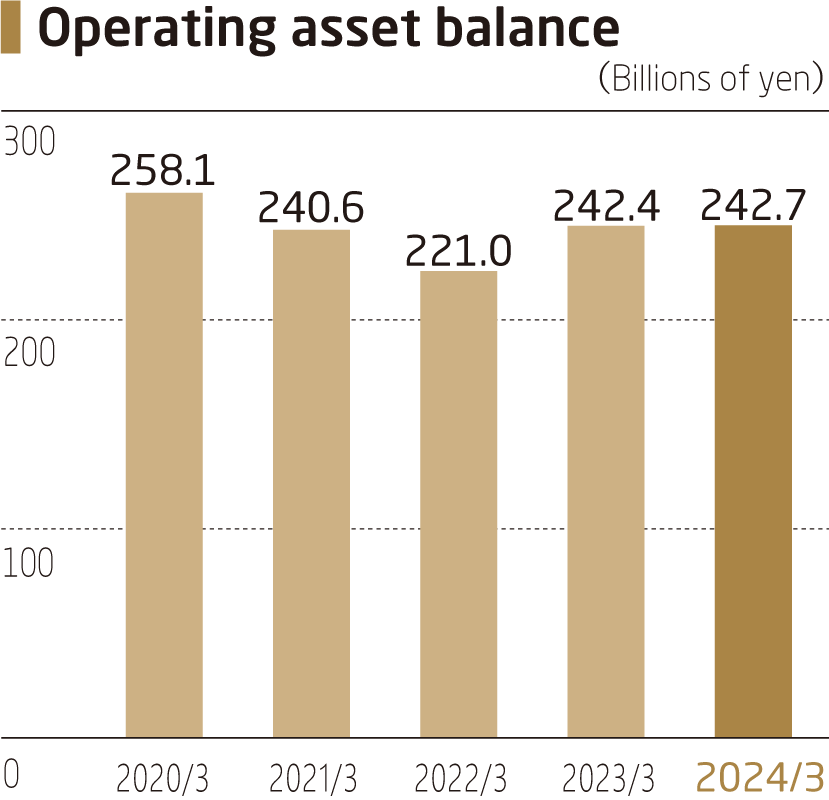

Our Finance Business includes corporate loans and factoring.

Monetary loans are primarily company or project-oriented (project financing). In addition to providing

financing to customers when they invest in plant and equipment, etc., we also offer various types of

receivables liquidation programs or other offers to our customers and their customers.

For project financing, we offer loans to the Special Purpose Company (SPC) established for a given

project, and can also provide the SPC with capital financing through investment allocation of stocks (for

the latter case, included in security investments in the financial statement).

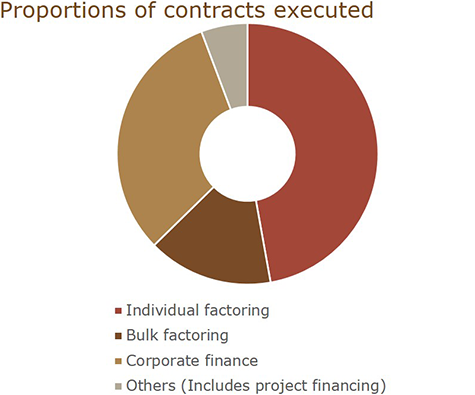

Factoring is a service that offers the advantages of efficient, timely capital procurement with early

clearing of the customer’s accounts receivable. We offer individual factoring for corporate customers and

bulk factoring for NEC Group.

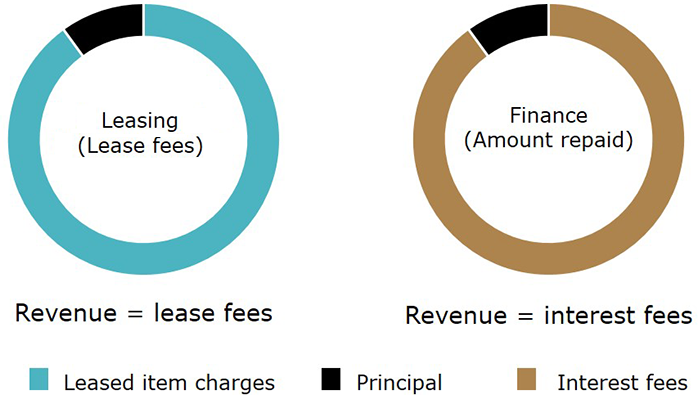

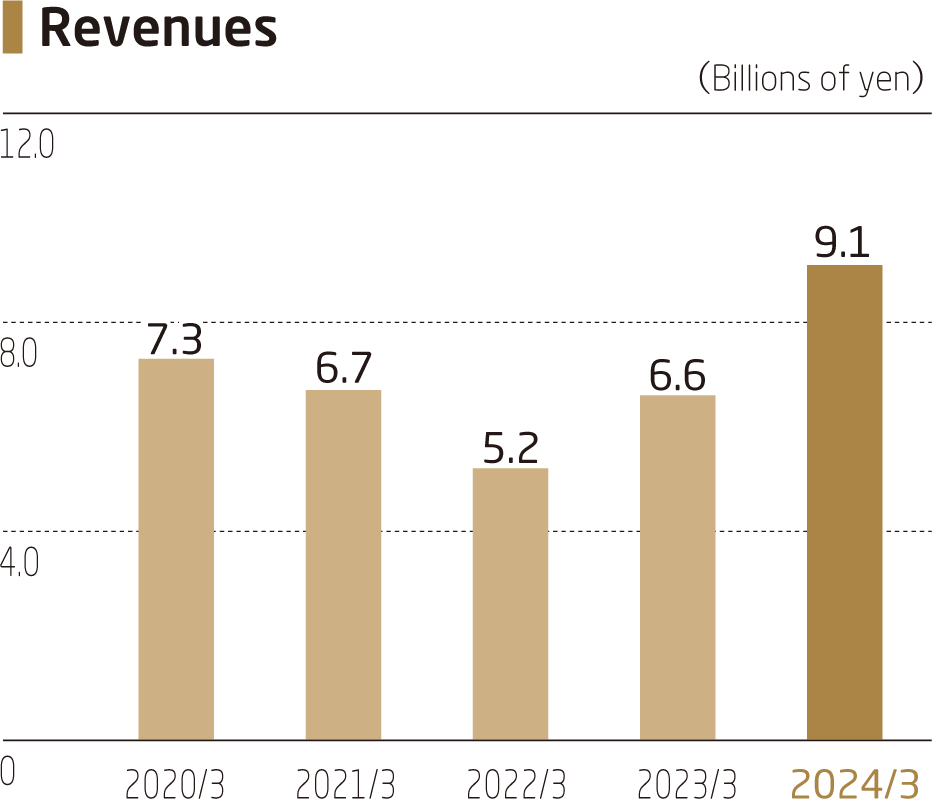

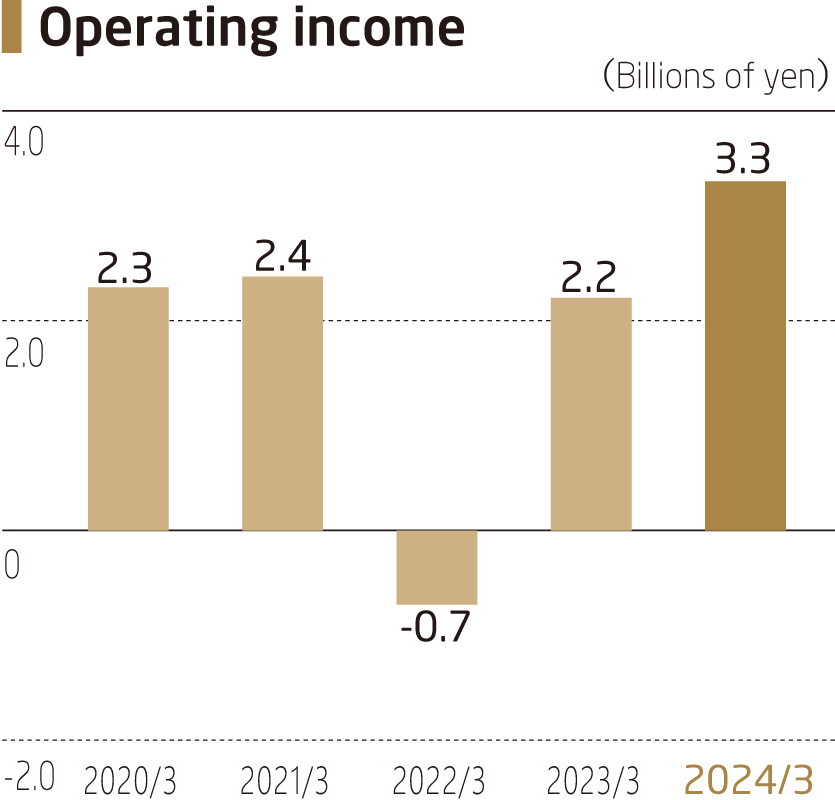

Revenue from the Finance Business has become extremely small compared to revenue from the Leasing Business. This is because revenue recorded for the Leasing Business includes leased property charges calculated as “lease fees” that include interest fees, etc., whereas in the Finance Business, only the interest fees are calculated into the revenue. At the gross profit stage, the Finance Business comprises 19% of the overall amount.