サイト内の現在位置

Our Strength

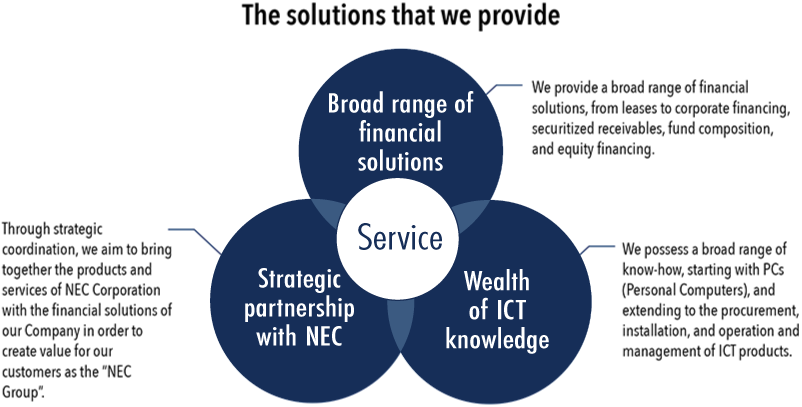

We provide solutions to issues related to the managerial resources of our customers through our unique services founded in the three strengths which we have cultivated since our founding.

Strategic partnership with NEC

NEC, which boasts cutting-edge technology such as biometric authentication and AI, focuses on businesses that use ICT to solve social problems to create a society in which humans can live brighter lives. Strategic partnerships allow us to integrate NEC products and services with our financial solutions to create value together with customers as part of the NEC Group.

Supporting the NEC Group’s business on the financial side

One example is government agencies and municipalities. NEC offers government agencies and municipalities solutions integrating ICT and a wide range of technology, and helps to enhance operational efficiency and raise the quality of public services. By collaborating with NEC and NEC Group companies and providing the optimal solution, we pursue initiatives that lead to the construction of social infrastructure, such as public infrastructure.

In addition, for private-sector companies, we consolidate NEC’s expertise on ICT and our specialized financial knowledge to provide integrated proposals as a solution business, and take up programs that meet our customers’ wide range of requests.

Wealth of ICT knowledge

Since we were established to handle the sales financing function for NEC products, we work with a high volume of ICT products, which account for over three fourths of the leasing contracts executed.

Our long history of handling ICT products has improved our knowledge of ICT products, and given us a wide-ranging expertise, not only in the leasing of ICT products, but the procurement, introduction, operation, and management of ICT products.

Services tailored to the unique life cycle of ICT products

The pace of technology innovation in ICT equipment is fast, which means that the desire to upgrade to the most recent models results in a higher turnover when compared to other equipment. ICT equipment is also known for its cumbersome lifecycle management (LCM), from introduction to operation, maintenance and disposal.

We receive many requests from customers who want to use ICT equipment without owning it (accounting for it as an expense) and wanting to lower the cost of owning ICT equipment. In response, we provide our “PIT managed service” that focuses on lifecycle management for ICT equipment, and our “N-rental” service, which provides ICT equipment for relatively short rental periods.

We have also developed peripheral businesses relating to ICT products. Our subsidiary Reboot Technology Services and Capitech Limited provides services relating to kitting of ICT products and sells ICT equipment after product leases have expired. This provides customers with a one-stop solution for their needs.

Broad range of financial solutions

Since we were established to handle the sales financing function for NEC products, our growth has been focused on leasing. In addition, as a manufacturer-affiliated leasing company, we have provided financing programs from the perspective of manufacturers and sales companies.

At present, in our role as a financial service provider, we provide a wide range of financial solutions from financing for companies and the securitization of receivables to fund formation and equity investing, in addition to our initial services.

Providing financial services from the perspective of manufacturers and sales companies

Vendor financing is a method whereby manufacturers and sales companies sell products and include payment plans for customers. Combining the manufacturers’ and sales companies’ strengths with their products with our financing programs distinguishes us from the offerings of competing companies. We help manufacturers and sales companies expand their sales by leveraging our experience supporting the sale of NEC products and services from a “vendor finance” perspective.

RISA Partners, a professional firm specializing in finance, investment, and advisory services

RISA Partners, our subsidiary, is a professional firm that specializes in services for financial institutions. The firm provides solutions for the management issues faced by the business partners of financial institutions’ customers in terms of both financing and investment to support the financial side and advisory services, providing expert advice on financing and real estate. RISA Partners uses not only corporate loans, but also equity investment through funds to provide eligible companies with support for their business revitalization, as well as IPO support.

Reboot Technology Services and Capitech Limited

Reboot Technology Services and Capitech Limited